Data and insights

See how BlueMark’s benchmarks, ratings, and data on leading impact investment practices can help drive client insights.

Our reach

*As of January 2026

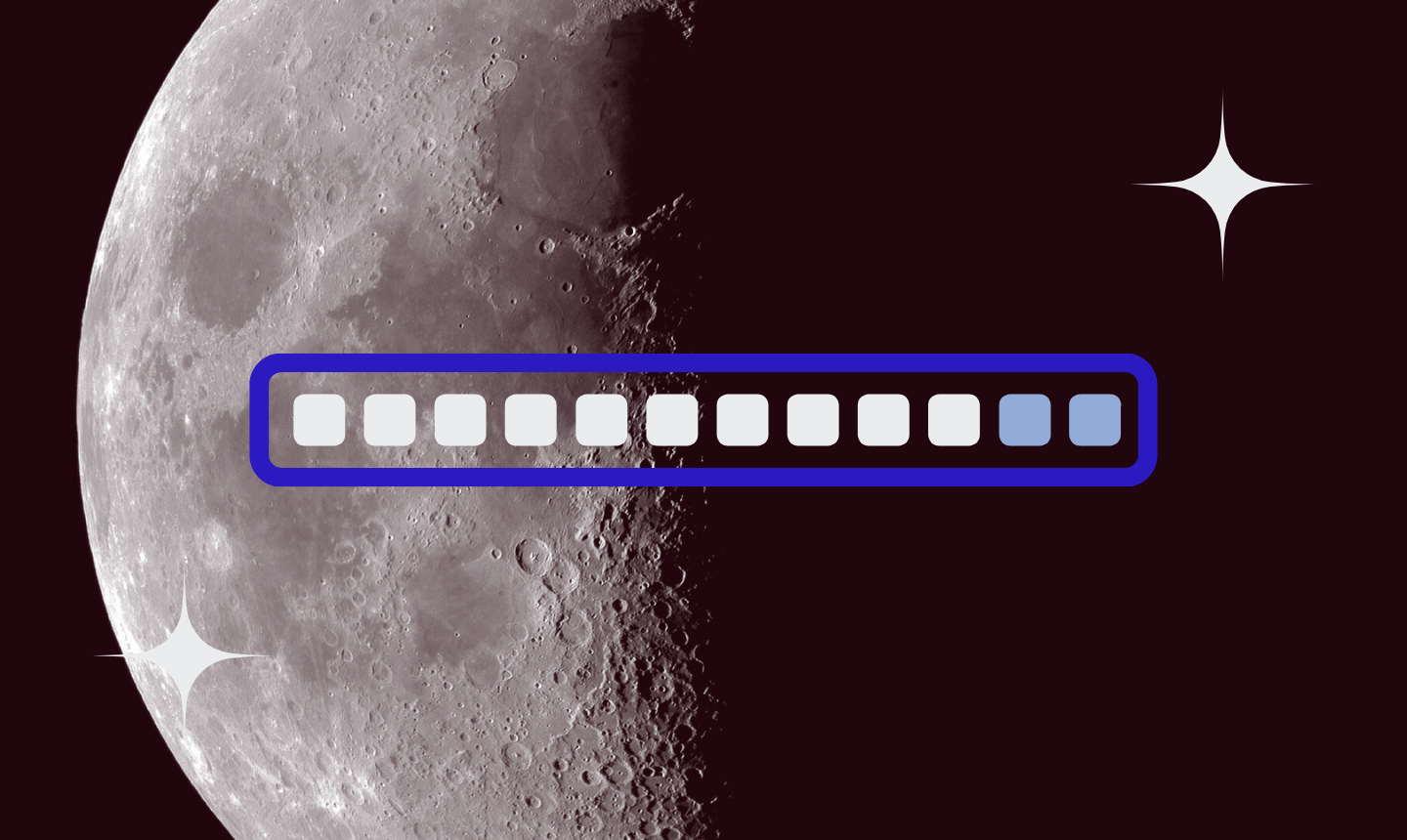

Practice Benchmark

BlueMark’s proprietary rating system evaluates the degree of investor alignment with core pillars of impact management on a four-part scale (Low, Moderate, High, Advanced).

The BlueMark Practice Benchmark organizes the aggregated results from BlueMark’s 153 most recent practice verifications into Learning (25th percentile), Median (50th percentile), and Leading (75th percentile) segments.

LOW

moderate

High

Advanced

1 IMPACT OBJECTIVES

2 IMPACT MANAGEMENT

3 INVESTOR CONTRIBUTION

4 IMPACT SCREENING

5 ESG RISK MANAGEMENT

6 IMPACT MONITORING

7 IMPACT AT EXIT

8 IMPACT REVIEW

25%

25%

LEARNING

MED.

50%

MEDIAN

75%

75%

LEADING

BlueMark Practice Leaderboard

The BlueMark Practice Leaderboard was created as a way to highlight those impact investors with best-in-class impact management practices. To earn a spot on the Practice Leaderboard, verified investors must receive top quartile ratings across all eight Practice Verification areas within the benchmark for that year.

Approximately 8% of BlueMark verified clients are on the Practice Leaderboard. Only impact investors that have been verified within the previous two years will be eligible for each year’s Practice Leaderboard to ensure that investors are continuously reassessed against the current state of the market.

Actis

- Infrastructure

- Resource Efficiency

- Climate Adaptation & Resilience

- Clean Energy

- WASH

AiiM Partners

- Sustainability and Equity

Bain Capital Double Impact

- Education & Workforce Development

- Health & Wellness

- Sustainability

Better Society Capital

- Multi-theme

BlueOrchard

- Multi-theme

British International Investment

- Productive, Sustainable and Inclusive

Brookfield

- Clean Energy

- Infrastructure

- Climate Change Mitigation

- Resource Efficiency

Calvert Impact Capital

- Access to Community Services

- Climate Change

- Financial Inclusion

Circulate Capital

- Climate Adaption & Resilience

- Climate Change Mitigation

Circularity Capital

- Resource Efficiency

- Climate Change Mitigation

- Climate Adaptation & Resilience

Finance in Motion

- Green Economy

- Climate Finance

- Entrepreneurship & Livelihoods

- Financial Inclusion

Franklin Templeton Social Infrastructure

- Affordable Housing

- Clean Energy

- Climate Adaptation & Resilience

- Health and Wellness

- Infrastructure

Impact Fund Denmark

- Green, Just and Inclusive Transition

Nuveen Global Fixed Income Impact

- Affordable Housing

- Renewable Energy and Climate Change

- Community and Economic Development

- Natural Resources

Nuveen Private Equity Impact Investing

- Resource Efficiency

- Inclusive Growth

Nuveen U.S. Affordable Housing

Schroders

- Multi-theme

Trill Impact

- Multi-theme (SDG-aligned impact)

The Vistria Group (TVG)

- Healthcare

- Financial Inclusion

- Education & Workforce Development

Research

As part of BlueMark’s mission to “strengthen trust in impact and sustainable investing,” we are committed to publishing field-building research based on our analysis of client verifications. These research reports are designed to inform investment practitioners about best practices and shared challenges, thereby driving the entire impact investing field forward.

Perspectives and commentary

BlueMark regularly publishes opinion pieces and comment letters to share our perspective on the biggest issues facing impact investors.

Events and webinars

BlueMark regularly hosts webinars and speaks at industry events about impact verification and key trends and challenges across the impact investing industry. Use the video library below to catch up on recent BlueMark speaking appearances.