BlueMark clients engage our services for a wide array of reasons, as they’ve told us in their client testimonials. These reasons often include complying with requirements from investors and voluntary standards, identifying opportunities for improvement, and perhaps most commonly, increasing the visibility of the fund with potential investors and other stakeholders.

Engaging BlueMark for an impact assessment can increase a manager’s visibility in a crowded field of funds through two main channels. First, BlueMark has partnered with several groups to increase BlueMark’s exposure via platforms and media outlets routinely viewed by asset owners and allocators. Second, BlueMark clients are listed on our website and in our market intelligence platform, with best-in-class performers highlighted on our leaderboards.

Visibility in Key Platforms

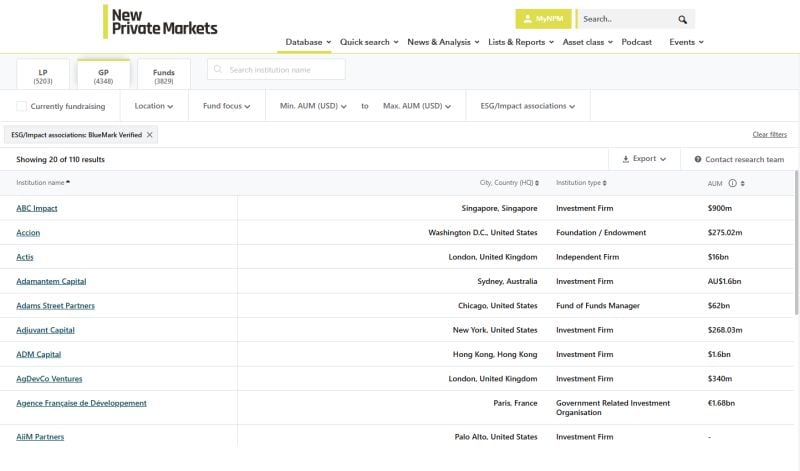

PitchBook, New Private Markets, and ImpactAlpha have integrated BlueMark verification data into their fund directories, meaning that users of the platforms can easily search for and see whether a manager has undergone a Fund ID assessment or one of BlueMark’s other services.

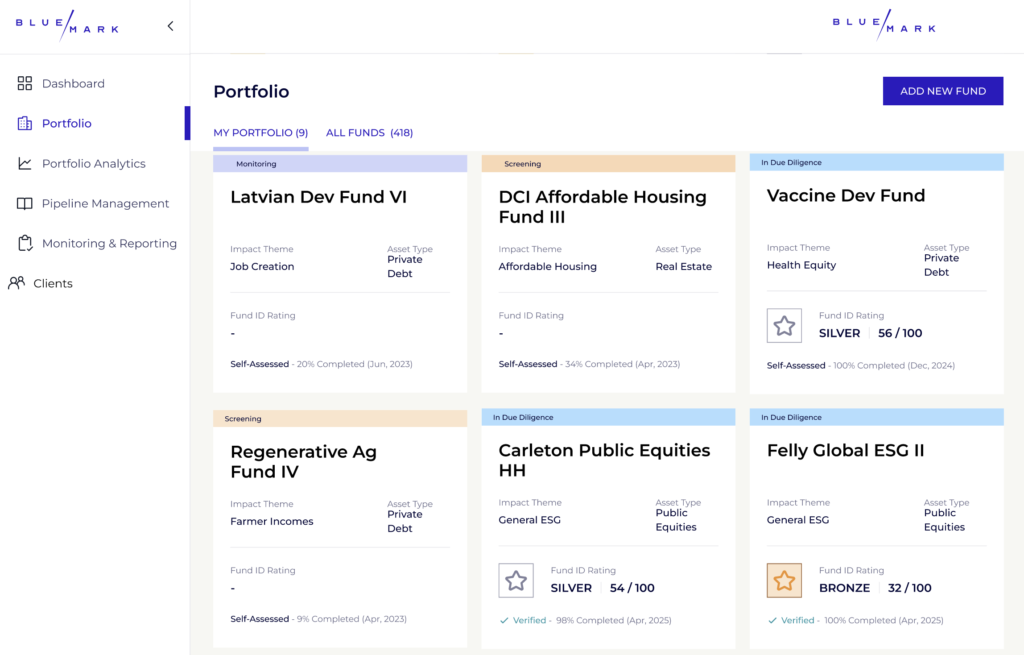

Additionally, BlueMark IQ, our new market intelligence platform designed for asset allocators, features a directory of verified funds with explicit impact and sustainability objectives. Allocators using the platform will be able to search the directory to identify, learn more about, and connect with funds of interest.

Note: the fund names shown are fictional and intended solely to demonstrate features.

Fund ID and Practice Leaderboards

BlueMark publishes two leaderboards to recognize and highlight funds and managers who have demonstrated exceptional impact practice: the Fund ID Leaderboard and the Practice Leaderboard. Funds can earn a spot on the Fund ID Leaderboard by achieving a “Platinum” rating in our Fund ID Assessment, while managers can qualify for the Practice Leaderboard by receiving top quartile ratings across all eight pillars of our Practice Verification.

Our clients often highlight their BlueMark verification seals in their pitch materials, on their social media channels, and in their conversations with prospective investors as a credible indicator of their leadership in the sustainable and impact investing market.

Verifying your impact fund not only signals your commitment to impact and helps you understand where to improve, but also offers these important channels to raise the visibility and credibility of your fund to impact-focused LPs.

Matt Donovan is a Senior Analyst at BlueMark.